marin county property tax rate

Director of Finance County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax Rate Areas 610 has been prepared for informational purposes by my. Ad Find Information On Any Marin County Property.

Marin County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Marin County Property Search.

. County of Marin business license tax schedule information. Director of Finance County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax Rate Areas 1027 has been prepared for informational purposes by my. A county-wide sales tax rate of 025 is applicable to localities in Marin County in addition to the 6 California sales tax.

Tax Rate Book 2021-2022. A combined city and county sales tax rate of 30 on top of Californias 6 base makes Fairfax one of the more expensive cities to shop in with 1717 out of 1782 cities having a sales tax rate. Get free info about property tax appraised values tax exemptions and more.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. ARROW Auditor-Controller County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax. If you have questions about the following information.

Establishing tax levies estimating property worth and then receiving the tax. All reasonable effort has been made to ensure the accuracy of the data provided. An application that allows you to search for property records in the Assessors database.

The Marin County Sales Tax is 025. The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax. Taxing units include city county governments and various.

Your property taxes would remain at 3500 instead of the new rate of. Tax Rate Book 2020-2021. The County collects the tax levies for all cities special districts and school districts as well as the tax levies for County purposes.

Tax Rate Book 2018-2019. Secured property taxes are payable in two 2 installments which are due November 1. Tax Rate Book 2019-2020.

A combined city and county sales tax rate of 225 on top of Californias 6 base makes Mill Valley one of the more expensive cities to shop in with 1320 out of 1782 cities having a sales. For example the property taxes for the home that you have owned for many years may be 3500 per year. General information on supplemental assessments and supplemental property tax bills.

If you are planning to buy a home in Marin County and want to understand the size of your property tax bill and. Tax Rate Book 2017-2018. This service has been provided to allow easy access and a visual display of county property tax information.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. A valuable alternative data source to the Marin County CA Property Assessor. For comparison the median home value in Marin County is 86800000.

Find Marin County Online Property Taxes Info From 2022. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests. The minimum combined 2022 sales tax rate for Marin County California is.

The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of. This is the total of state and county sales tax rates. There are 69 autonomous entities in Marin.

Property Tax Bill Information and Due Dates. MARIN COUNTY PROPERTY OWNERS From. Overview of Marin County CA Property Taxes.

Secured property tax bills are mailed only once in October. Mina Martinovich Department of Finance. What is the sales tax rate in Marin County.

Overall there are three stages to real estate taxation. Some cities and local.

Transfer Tax In Marin County California Who Pays What

Marin County Policy Protection Map Greenbelt Alliance

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County Suspends New Short Term Rentals In Western Areas

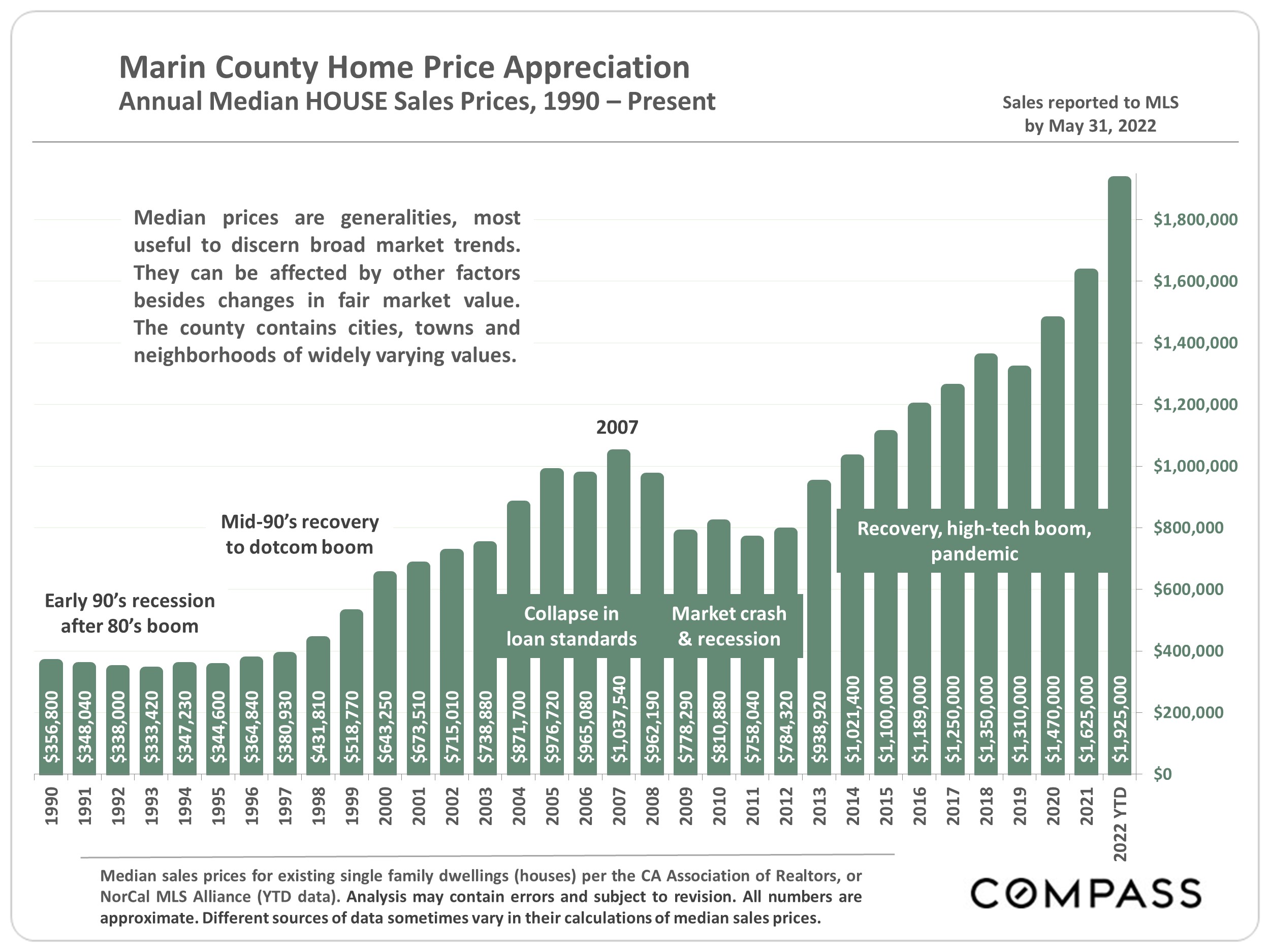

Marin County June 2022 Real Estate Report

Transfer Tax In Marin County California Who Pays What

Marin County California Property Taxes 2022

Transfer Tax In Marin County California Who Pays What

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County Policy Protection Map Greenbelt Alliance

Marin County Real Estate Market Report January 2018 Trends Market News Marin County Real Estate Real Estate Marketing Real Estate

Marin Economic Forum Mef Blog Marin Economic Forum

Marin Economic Forum Mef Blog Marin Economic Forum

Marin County California Fha Va And Usda Loan Information

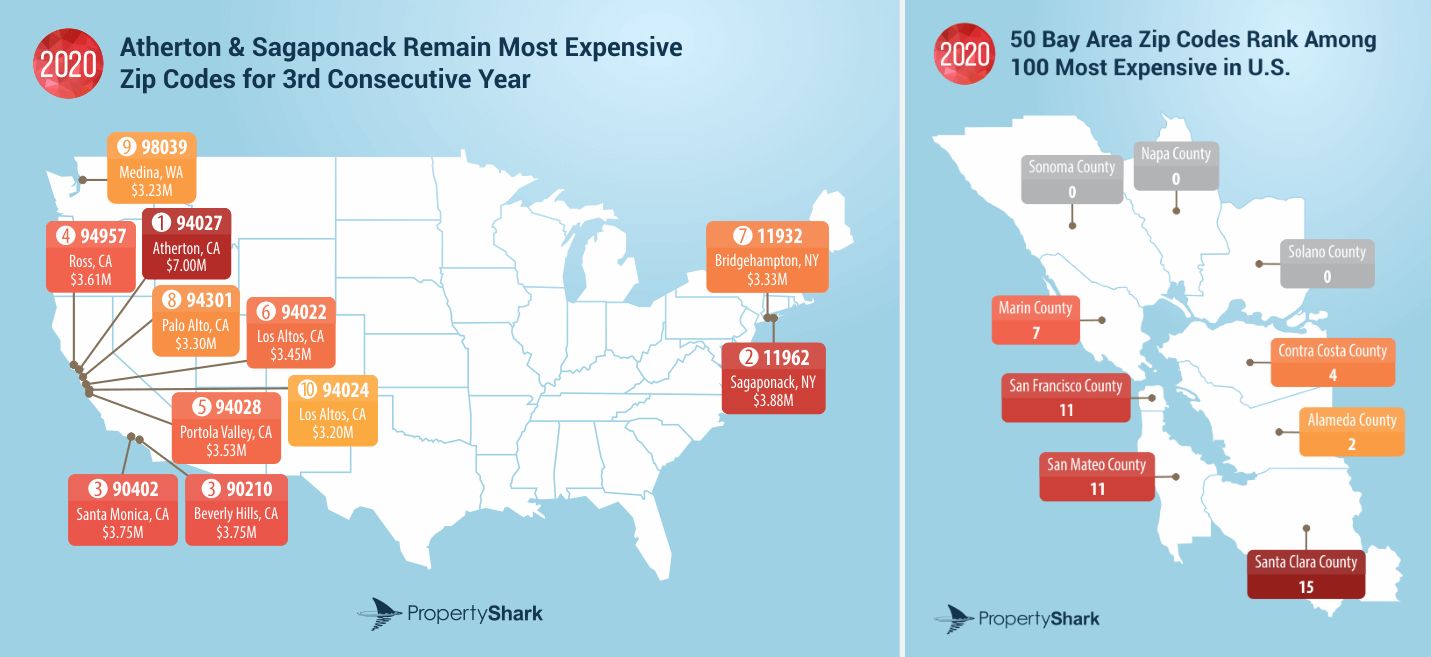

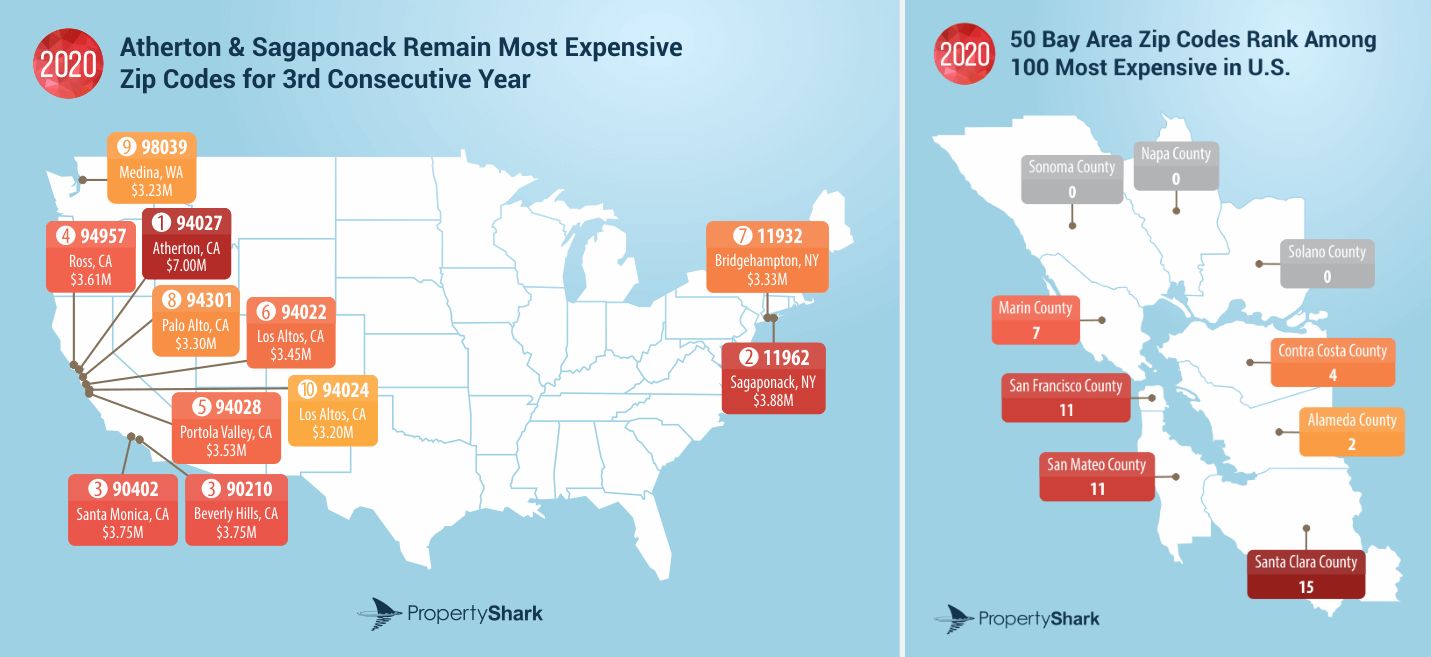

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Marin County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Job Descriptions Career Opportunities At Marin County Superior Court

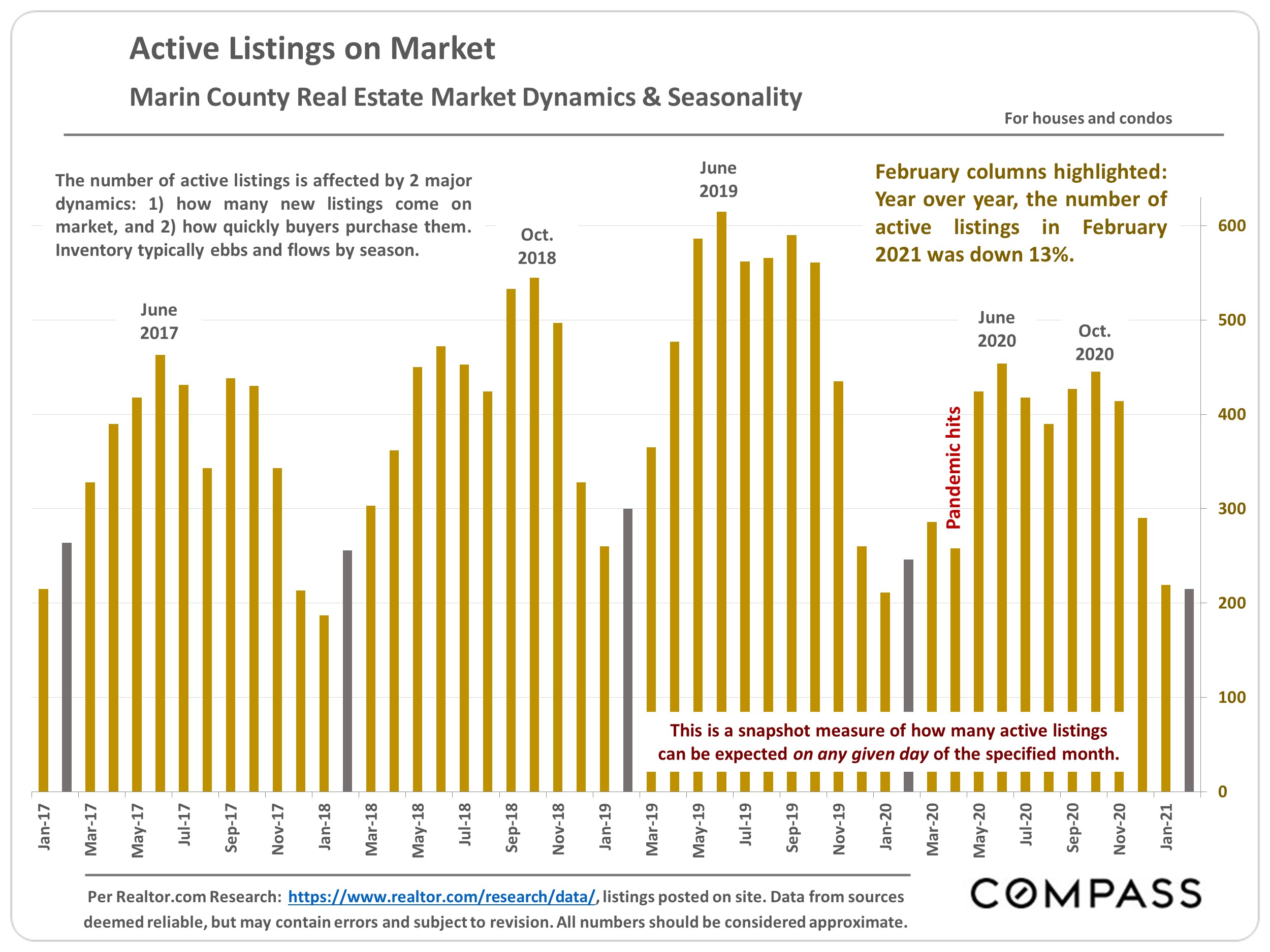

Marin Community And Real Estate Market Report 3 16 21 Marin County Real Estate Agents