philadelphia wage tax refund

Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city. Who pays the tax.

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

The current Philadelphia wage tax is 38712 for residents of Philadelphia and 35019 for non-residents.

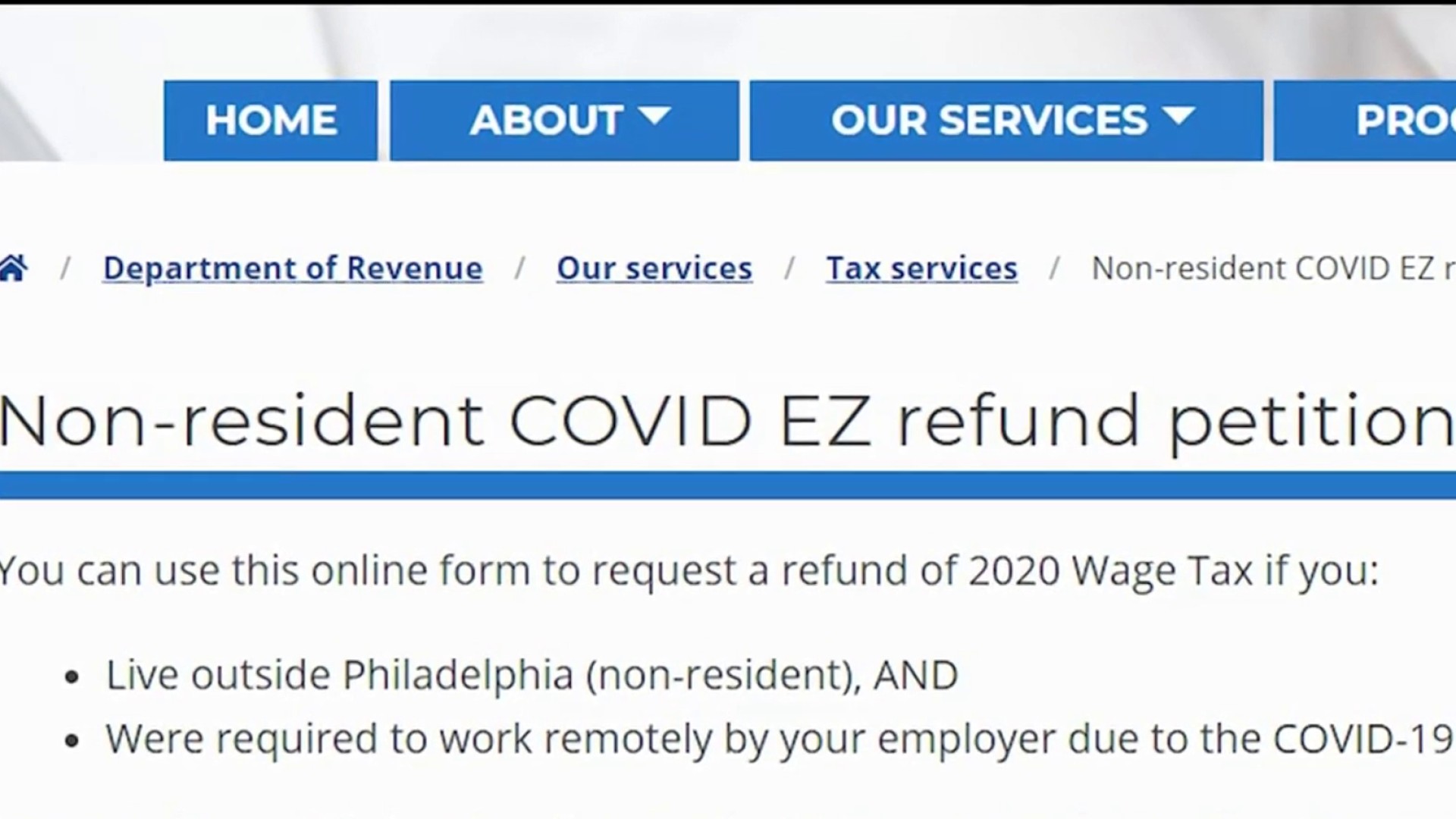

. 2021 COVID EZ Request. Eligibility for Wage Tax refunds - For nonresidents Philadelphia uses a requirement of employment test to determine whether Wage Tax withholding is required. For refund-related inquiries please call 215 686-6574 6575 or.

The COVID EZ Request form covers the period from January to August 2021. 2021 Time Worked Outside of Philadelphia. The letter signed and on company letterhead must include the dates you were required to work outside Philadelphia.

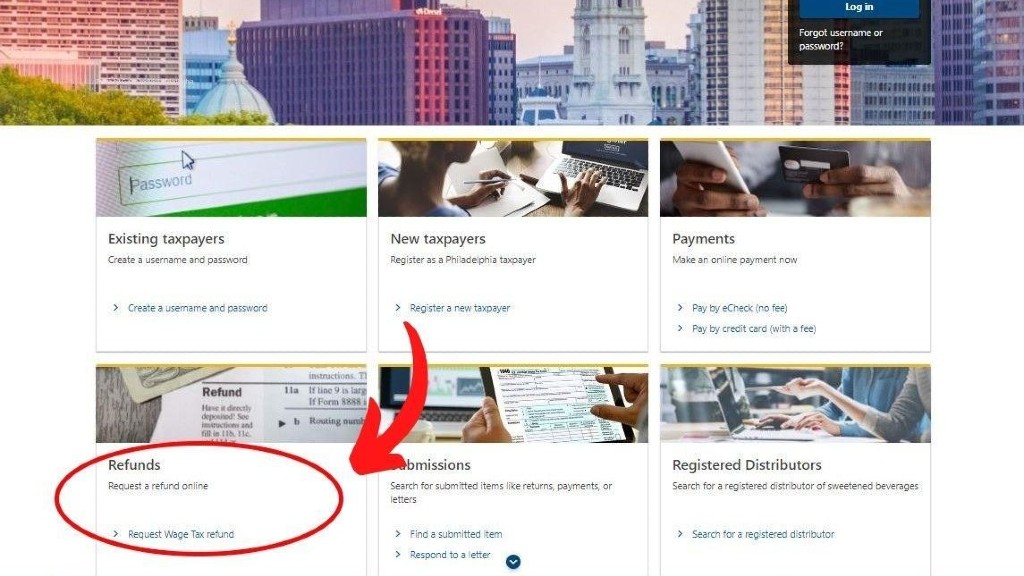

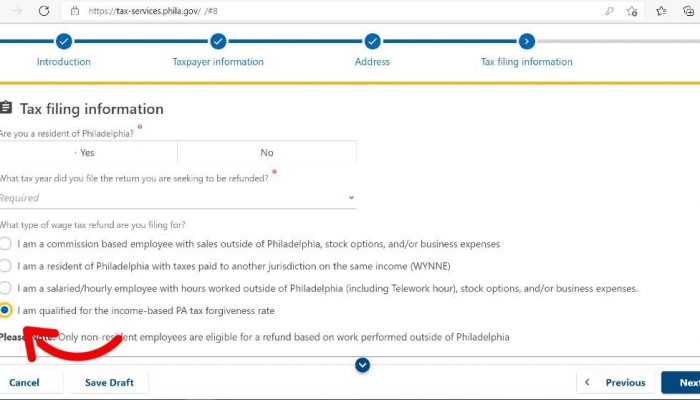

A new website the Philadelphia Tax Center is designed to provide better service to taxpayers with the best way to pay file and amend business taxes. The online forms for a city wage tax refund went live at the end of January. The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents.

Philadelphia City Wage Tax Refunds FAQs. How to Request a Refund. Paying and receiving refunds for the Philadelphia wage tax is now an online process.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. Non-residents who work in Philadelphia must also pay the Wage Tax. Visit Corporate Tax Compliance and Payroll.

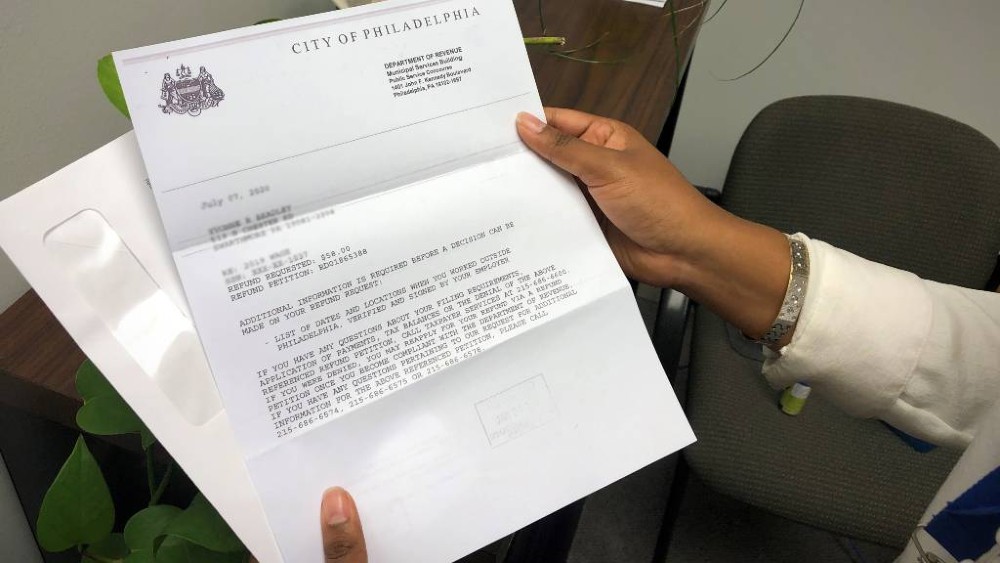

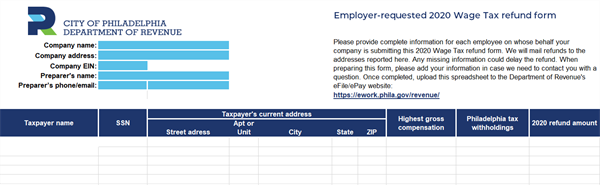

Erin Arvedlund tallied up the impact for The Philadelphia Inquirer. 2020 COVID EZ Phila CWT Refund Letter. Philadelphia city has launched a new online Philadelphia Tax Center which makes it easier to pay wage taxes but also to apply for a refund if you still work from your home outside the city.

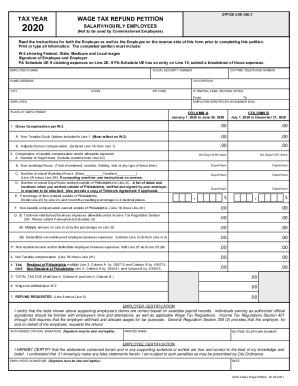

For 2020 and 2021 the Philadelphia Department of Revenue has created a COVID-EZ Refund Petition form. The City announced it expects to post the form during the first. Under this test a nonresident is exempt from the Wage Tax for the days.

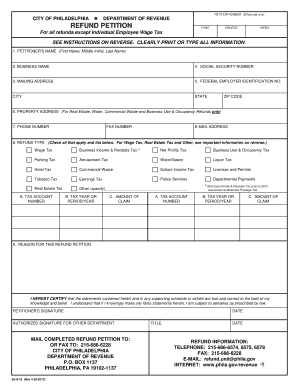

Philadelphia City Wage Tax Refund forms are now available on the City of Philadelphia website. Non-residents who work in Philadelphia must also pay the City Wage Tax. Because the City of Philadelphia is expecting an extreme increase in the number of refund petitions for 2020 they have attempted to make the process easier.

The city has approved about 32000 applications for 2020 thus far Lessard said compared with. All refund requests with the exception of Wage Tax are being processed in order of the date received. The 105 million that Philadelphia expects to repay nonresidents represents just 62 of the 159 billion in wage tax revenue the city collected in the last fiscal year.

How to Get Your Philadelphia City Wage Tax Refund. The tax applies to payments that a person receives from an employer in return for work or services. Youll need a letter from your employer or from payroll to accompany your refund request.

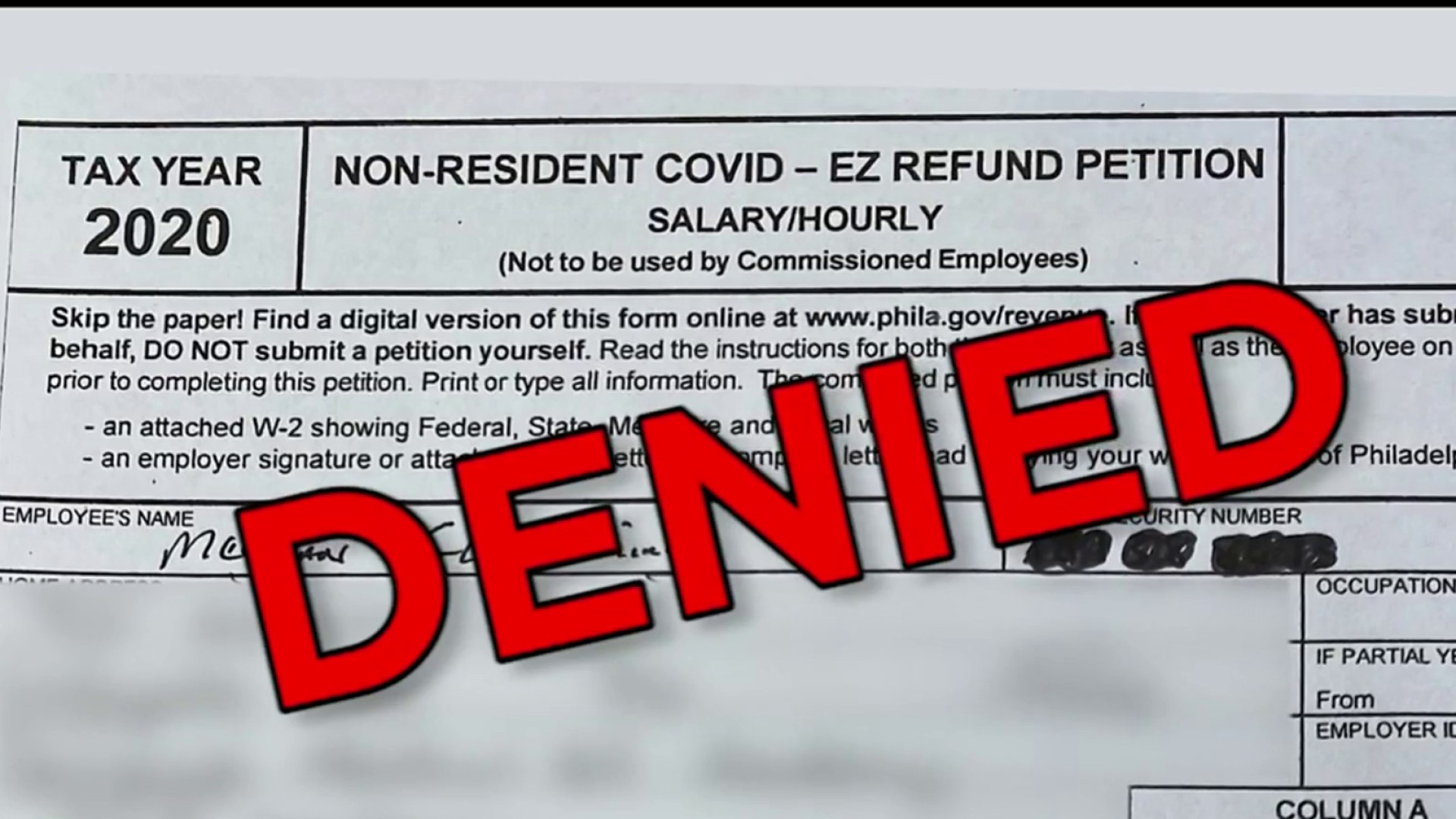

Philadelphia Wage Tax Refunds Delayed Due to 500 Increase in Applications NBC10 Philadelphia. So you might think non-residents who worked from home during the. Were always working to improve philagov.

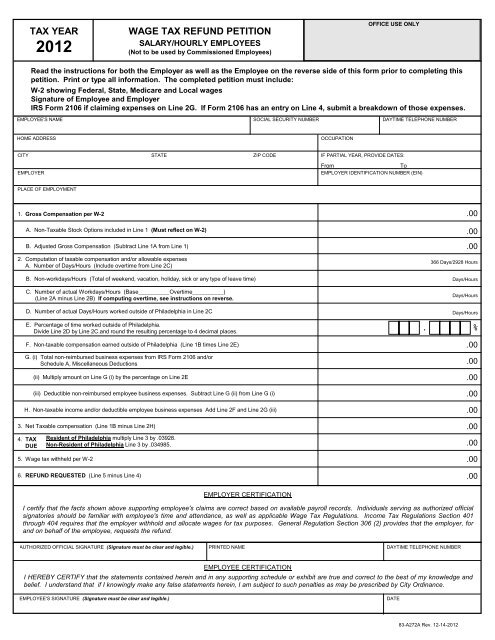

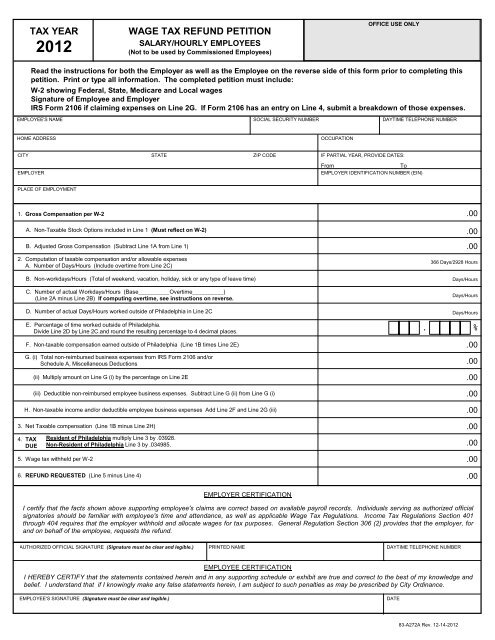

If your company doesnt file en masse you can file for your own refund. Prior to 2020 to request a refund of wage taxes paid employees had to file and submit a Wage Tax Refund Petition to the city. These are the folks who might be in line for a refund.

Philadelphia Wage Tax Refund Petition Instructions. The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022. This content was last updated on May 17 2022 by Department of Revenue.

Philadelphia City Wage Tax 2020 -- claim NJ credit andor Phila refund. Individuals who reside outside of the City of Philadelphia and had Philadelphia Wage Tax deducted for days that they were required to work from home may complete the form to request a refund. 2022 Wage Tax by industry.

You are double dipping if you claim a credit for taxes that will be refunded to you on a Non-Resident Covid Ez Refund Petition. This form could not be filed electronically. PdfFiller allows users to edit sign fill and share all type of documents online.

1111 am EST February 4 2022. While Philadelphia residents are eligible for refunds of City Wage Tax if they paid tax to other local jurisdictions ie Wilmington Delaware we are going to focus on refunds for non-residents as the pandemic has changed how and where. Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481.

This applies to all nonresidents whose base of operations is the employers location in Philadelphia. Have recommendations or feedback. All Philadelphia residents owe the City Wage Tax regardless of where they work.

The wage tax issue is really hot right now said Jennifer Karpchuk tax attorney and shareholder at Chamberlain Hrdlicka in Conshohocken. Although paper versions of the 2021 online Wage Tax petitions are available we encourage you to use the online form. Wage Tax refund requests for 2020 can be submitted with accompanying W-2 forms starting in 2021.

2021 Income-based Wage Tax refund petition non-residents PDF. How you can file for your city wage tax refund. Employees claiming a Philadelphia City Wage Tax Refund should complete only one of the following forms.

Give Us Feedback. Non-residents residents can use this form to request a refund for Wage Tax amounts you paid if youre eligible for income-based reductions. 2020 Philadelphia City Wage Tax Refunds.

Wed love to hear from you. If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center please call 215 686-6600. This will ensure fewer errors and faster processing.

Have a consumer complaint. May file for a refund with an online Wage Tax refund petition in 2021. Ad Download Or Email 83-A272 More Fillable Forms Register and Subscribe Now.

The City Wage Tax is a tax on salaries wages commissions and other compensation. As of January 8 2021 the City of Philadelphia has not updated their portal with a Wage Tax Refund Petition Form for 2020. 1154 pm EST February 3 2022 Updated.

You can only claim a credit on. Employees will need to provide a copy of their W-2 form and a letter from their employer stating they were. We expect the normal 6-8 week processing time to be longer this year.

But this years refunds still account for much more money than in years past due to the pandemic. The Department of Revenue has provided important reminders regarding the new electronic processes for 2022. Philadelphia Wage Tax.

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

How To File For The Philadelphia Wage Tax Refund Nbc10 Philadelphia

Tax Refund Philadelphia Fill And Sign Printable Template Online Us Legal Forms

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Tax Refund Philadelphia Fill Online Printable Fillable Blank Pdffiller

Income Based Wage Tax Refund Petition Fill Out And Sign Printable Pdf Template Signnow

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Wage Tax Refund Petition Tax Year

City Council Approves Bill To Help Philadelphians Collect More Than 600 Million In Tax Refunds Philadelphia City Council

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

Philadelphia Workers Who Stayed Home May Be Due A Wage Tax Refund East Rockhill Township

Success Wage Tax Refund R Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance